February went down the toilet, breaking the November lows, 20 year trend lines and a new monthly closing low. Not good signs. With all the doom going on, I had my best day trading week thus far. Finished the month in the green. Just sticking to my rules and waiting for the trade to come to me. Can be pretty boring, but it's cool when it works!

Reviewing some of the market indicators and how they reacted in the recent past, we should get some kind of movement in about 15-20 days starting from the Feb 23rd low. So late next week we could have a nice little rally. Just in time for St. Patty's day??

Mark Wrap 2/25/09

Another roller coaster ride with the markets today. Best day trading results so far with a number of trades with FAZ, FAS, COST, DXO, BGZ & TLM.

Looks like distribution days across the indexes. The market tanked in the early hours; then recovered before Obama's comments and headed south again as he opened his mouth. Not sure why he didn't wait until after the markets closed?

Looks like distribution days across the indexes. The market tanked in the early hours; then recovered before Obama's comments and headed south again as he opened his mouth. Not sure why he didn't wait until after the markets closed?

Market Wrap 2/24/09

Today had big gains across the board. The S&P up 4%, the DJI up 3.3% and the Naz 3.9%. I heard Bernanke painted a rosy picture saying the end of the recession will be around the end of 2009. He must be passing the bong with Phelps.

It was a 90% up-day. Even though a lot of short covering going on, we should get a nice little rally over the next few days to weeks. The McLellan was around -340 yesterday, which signals a good buying opportunity. Should get confirmation soon if the rally is to continue.

I dabbled in some FAZ for a small profit while it nose dived. Also picked up some FDLR and holding it for a bit.

It was a 90% up-day. Even though a lot of short covering going on, we should get a nice little rally over the next few days to weeks. The McLellan was around -340 yesterday, which signals a good buying opportunity. Should get confirmation soon if the rally is to continue.

I dabbled in some FAZ for a small profit while it nose dived. Also picked up some FDLR and holding it for a bit.

Market Wrap 2/19/09

Another choppy day in the markets as it tries to decide if it's a tank or airplane. Came out with 4 smackers, so am a happy pilot either way.

The S&P closed below 800. Friday will be important to see if we get a weekly close below 800. The DJ30 undercut the November lows and closed just above it. A nice little head fake. Hard to imagine the market tanking just as people are contributing to their IRA's. Could have a nice rally until late April.

The S&P closed below 800. Friday will be important to see if we get a weekly close below 800. The DJ30 undercut the November lows and closed just above it. A nice little head fake. Hard to imagine the market tanking just as people are contributing to their IRA's. Could have a nice rally until late April.

Market Wrap 2/17/09

Markets sold off hard today. Lots of bad news over the weekend with Japan's GDP tanking and Switzerland borderline insolvency among the top items. Obama signed the new stimulus bill into action today and the market sold off to it's lows after that.

Indicators are all down. It was a 90% down day, the McLellan Summation turned down. The S&P, DJ30 and NASDAQ all undercut the recent lows which will surely put the status back to Market in Correction.

I stayed out the entire day as a spectator. I was traveling back from Miami when the market opened and most of the damage had been done in the first couple of hours.

BWP, SYNA, SY & DMND look like a possible longs if the market bounces. QSII might be a good short, but it's part of the IBD 100. ASEI looks like another possible short.

Indicators are all down. It was a 90% down day, the McLellan Summation turned down. The S&P, DJ30 and NASDAQ all undercut the recent lows which will surely put the status back to Market in Correction.

I stayed out the entire day as a spectator. I was traveling back from Miami when the market opened and most of the damage had been done in the first couple of hours.

BWP, SYNA, SY & DMND look like a possible longs if the market bounces. QSII might be a good short, but it's part of the IBD 100. ASEI looks like another possible short.

Market Wrap 2/12/09

The markets were in tank-ity tank mode today. But then there was a leak that Obama is going to help pay for people's houses who are in trouble. Great. The DJI recovered from 200+ point decline to almost positive in about 45 minutes. Dorks! The recovery put the S&P back inside its triangle pattern. So could see a bounce up to test the upper TL around 900.

Then there was talk about creating all these jobs with the new stimulus plan by building/repairing roads and bridges. Well, not sure how many white collar workers and burger flippers are ready to get their hands dirty? I guess all those former home construction workers might be able to ramp up relatively quickly. And a lot of talk on CAT will benefit from heavy equipment sales. Well, there's already a lot of CAT equipment already sitting around and rusting that will most likely be used before any new equipment is ordered. Unless CAT has some hefty margins on parts? Not seeing any jump in revenue. I pass a sky-lift rental business on the Tri-Rail frequently and their lot is jammed full of cherry pickers. The I-95 expansion in WPB is nearing completion too, so those people will have to be re-allocated too.

Bought some GLD in the morning for $92.75 and then sold when things starting getting wacky for $93.55 - a nice little 80c profit. Better than a poke in the eye with a sharp stick as they say...

Then there was talk about creating all these jobs with the new stimulus plan by building/repairing roads and bridges. Well, not sure how many white collar workers and burger flippers are ready to get their hands dirty? I guess all those former home construction workers might be able to ramp up relatively quickly. And a lot of talk on CAT will benefit from heavy equipment sales. Well, there's already a lot of CAT equipment already sitting around and rusting that will most likely be used before any new equipment is ordered. Unless CAT has some hefty margins on parts? Not seeing any jump in revenue. I pass a sky-lift rental business on the Tri-Rail frequently and their lot is jammed full of cherry pickers. The I-95 expansion in WPB is nearing completion too, so those people will have to be re-allocated too.

Bought some GLD in the morning for $92.75 and then sold when things starting getting wacky for $93.55 - a nice little 80c profit. Better than a poke in the eye with a sharp stick as they say...

Timmy Tanked the Markets

Notables: 90% Down day, IBD Markets Under Pressure from undercutting previous low on higher volume.

Following a new 8/20 trading system, I see the SPY and DIA were excellent shorting setups from yesterday. I wasn't focused on the market, just observing and waiting to

see the reaction to the SEC statements and then the FED hearing. Nothing good coming on the horizon, except billions of people's IRA contributions in the next couple of months. Dow -4.62%, S&P -4.91%

Will be watching these on Wednesday as they are hanging on a trend line... SHEN AAON LPHI MCD SJI NCIT CPSI PETS

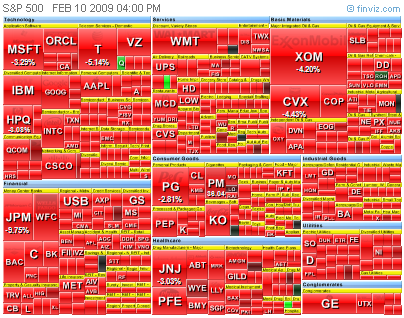

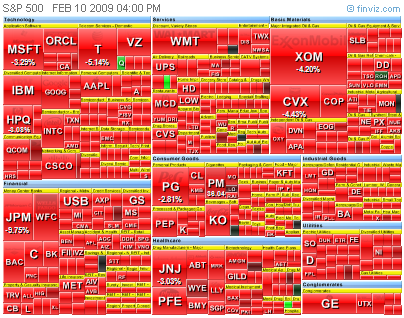

Just about everything was down...

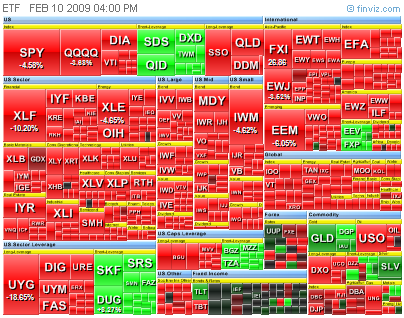

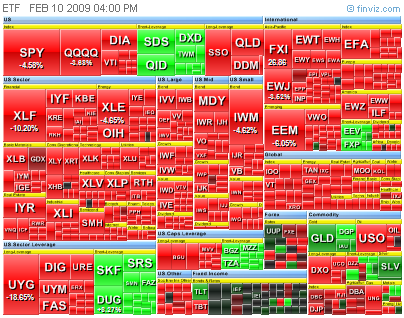

ETF activity...

Following a new 8/20 trading system, I see the SPY and DIA were excellent shorting setups from yesterday. I wasn't focused on the market, just observing and waiting to

see the reaction to the SEC statements and then the FED hearing. Nothing good coming on the horizon, except billions of people's IRA contributions in the next couple of months. Dow -4.62%, S&P -4.91%

Will be watching these on Wednesday as they are hanging on a trend line... SHEN AAON LPHI MCD SJI NCIT CPSI PETS

Just about everything was down...

ETF activity...

Weekend Review

Just catching up and review charts from over the weekend after the market close on Monday. Things to notice: 90% up day on Friday; IBD also changed status to Market in Confirmed Rally; McLellan Summation popped back above zero and the weekly S&P closed at the 13 SMA.

Didn't do much with the market today. Was on my way back from Miami and the stimulus bill was delayed until Tuesday.

Doing some research on TradeStation to consider it as a trading platform. They're coming to the area in April, so will wait until then to check it out.

Think or Swim updated their platform on Friday and another update today. Looks like at least one of my indicators doesn't work at the moment and it crashed TOS when trying to modify it.

Didn't do much with the market today. Was on my way back from Miami and the stimulus bill was delayed until Tuesday.

Doing some research on TradeStation to consider it as a trading platform. They're coming to the area in April, so will wait until then to check it out.

Think or Swim updated their platform on Friday and another update today. Looks like at least one of my indicators doesn't work at the moment and it crashed TOS when trying to modify it.

IBD 100 2009-02-02

Some IBD Stocks flirting with S/R/TL: CWT GENZ CMN DLTR ATHN HAE NITE SJI AZO ALG WW BLU EW ESI NVO EPIQ TTEK HMSY GMCR CMP TDG CFL SXCI GILD RAH MFE EBS GXDX AAON HS SXE APEI MCD JCOM

Subscribe to:

Posts (Atom)