Haven't been posting much lately. Have been wrapped up in a couple new trading strategies that are doing quite nicely. Will be trading them live soon...

Today was a 90% down day according to my self-made chart. The McLellan Summation is also turning down and about to cross its 10 day SMA. Stocks above their 50 day SMA is also starting to turn down. Gold is starting to go up. The S&P topped out at 930 so far, right below the 10 month SMA at 933... hmmm!? The S&P 5 day SMA is about to cross below the 9 day SMA, the first time since early March. The S&P also crawled above it's 13 wk SMA last week. Haven't had a full week above that SMA since Sept 2007!!

Today was also a distribution day for the S&P 500, DJ30 and NYSE. Have about 5 dist. days for the S&P for the past number of weeks which isn't good either.

No reasons to get excited. Some form of pullback is still coming and an eventual woosh to the bottom at some point...

Market Snapshot 2009-04-22

We're approaching a top in the S&P. Most are looking for a reversal. The S&P is at a 23% fib retracement.

Also testing resistance at $880.

The stocks above their 40 MA is also topping (bottom graph).

Also testing resistance at $880.

The stocks above their 40 MA is also topping (bottom graph).

Ninja Trader

Haven't posted in about two weeks!?

Played with Ninja Trader today. Love the crisp charts and like it a little better than QuoteTracker. A little more control over the chart formats, like dashed lines, candlestick sizes and indicator pane placement/overlap. The fib tool has a auto-complete feature that saves a bit of time. The ability to add indicators to the watchlist so you can do live screening is cool. It's a little slow to load charts, but that's mainly due to using TD Ameritrade as the quote source (same as QuoteTracker).

All my setups for today were green, except for one - GOLD.

Played with Ninja Trader today. Love the crisp charts and like it a little better than QuoteTracker. A little more control over the chart formats, like dashed lines, candlestick sizes and indicator pane placement/overlap. The fib tool has a auto-complete feature that saves a bit of time. The ability to add indicators to the watchlist so you can do live screening is cool. It's a little slow to load charts, but that's mainly due to using TD Ameritrade as the quote source (same as QuoteTracker).

All my setups for today were green, except for one - GOLD.

Market Wrap 3/23/09

Markets up huge on toxic asset buyout plan announced pre-market. Of course, the only day in months that I decide to sleep in. Most of the move was done by ten, and then about the time I got bored and went to run some errands, the market crept up some more in the late afternoon.

I don't even have to load my indicator charts to tell it was a 90% up day today.

Oh well... doesn't get much greener than this...

I don't even have to load my indicator charts to tell it was a 90% up day today.

Oh well... doesn't get much greener than this...

Market Wrap 3/18/09

Another big day in the markets. It was a choppy day up until Big Ben spoke that they've got money to burn. The markets took off after that for a nice little rally and then pulled back a little. S&P finished just under 800, the magic turning point.

My system suffered a lot of chop-outs, but was able to recover with a small loss on the day. Over traded and didn't wait for the news to unravel...

My system suffered a lot of chop-outs, but was able to recover with a small loss on the day. Over traded and didn't wait for the news to unravel...

Market Wrap 3/17/09

The markets finished up big, from 2.5 to 4% higher. The stocks I was trading were a bit choppy, so finished down on the day. Also turned out to be another 90% up-day. So it should get real interesting!

I have some nice screens in StockFinder that are actually working now and have improved performance by using my laptop for browsing and tweetdeck - they both consume a lot of memory. So I run StockFinder and TOS on my main PC.

Lots of animosity funneled at AIG for paying out bonuses after they get another chunk of bailout money. Not sure why the gov't doesn't go in and take over the companies and clean house. The reoccurring insanity is how people expect these financial geniuses that got us into this mess will get us out. Plus they are paid bonuses for failure?

I have some nice screens in StockFinder that are actually working now and have improved performance by using my laptop for browsing and tweetdeck - they both consume a lot of memory. So I run StockFinder and TOS on my main PC.

Lots of animosity funneled at AIG for paying out bonuses after they get another chunk of bailout money. Not sure why the gov't doesn't go in and take over the companies and clean house. The reoccurring insanity is how people expect these financial geniuses that got us into this mess will get us out. Plus they are paid bonuses for failure?

Market Wrap 3/16/09

Today was Tax Day, for those with businesses. So was working on my 1120 taxes most of the day. Was bummed I couldn't watch the market, but had some charts up in the distance and put in some orders before the bell range. 3 of the 4 orders were filled by 11am or so. The 4th never triggered, so canceled it. Watched for some pushes and sold out of a couple positions before noon and moved up the other stops. Then heard the "bling" sound signaling the final positions were stopped out in the afternoon.

Also did a short BGU trade around lunch time. The SPX pull back to the 20SMA on the hourly I believe, so put in an order and made some coinage.

The markets started tanking late afternoon. Ended up as a distribution day.

The last time there were two 90% up days like last week, the market moved sideways for just over two months. Who knows...

Just happy to make money and that only have to do my personal taxes now...

Also did a short BGU trade around lunch time. The SPX pull back to the 20SMA on the hourly I believe, so put in an order and made some coinage.

The markets started tanking late afternoon. Ended up as a distribution day.

The last time there were two 90% up days like last week, the market moved sideways for just over two months. Who knows...

Just happy to make money and that only have to do my personal taxes now...

Market Wrap 3/12/09

Rally Rama! A follow through day for IBD'rs. The S&P, DJIA & NYSE all followed through today on big gains.

Today was a profitable day with some early choppiness. Another 90% Up day, which last time that happened back in November the markets rallied for a couple of months. So it should be some good pickings for at least a month, until everyone has made their IRA contribution.

Today was a profitable day with some early choppiness. Another 90% Up day, which last time that happened back in November the markets rallied for a couple of months. So it should be some good pickings for at least a month, until everyone has made their IRA contribution.

Market Wrap 3/10/09

Major rally across all the stock markets today. DOW +5.8%, NASDAQ +7.07% S&P 500 +6.37%. Big numbers, but the market is so low it doesn't take much to move the markets when it gets some money behind them.

Today was a 90% up day, the McLellan Osc. turned up above -200, the Mc. Summation Index's downward thrust has pulled back. The S&P closed up above the 9 day EMA.

And I made money today! APOL chewed up a lot of profits, I was determined to make a trade with it, but it wouldn't behave for me. Not a good way to trade and it showed.

The newz was that Franks said they're pushing to revive the uptick rule. Whoo-p. Like it will change anything. And Citigroup said it was profitable for the last two months. Just as their stock was cheaper than a McDouble.

What does a big rally look like?

Today was a 90% up day, the McLellan Osc. turned up above -200, the Mc. Summation Index's downward thrust has pulled back. The S&P closed up above the 9 day EMA.

And I made money today! APOL chewed up a lot of profits, I was determined to make a trade with it, but it wouldn't behave for me. Not a good way to trade and it showed.

The newz was that Franks said they're pushing to revive the uptick rule. Whoo-p. Like it will change anything. And Citigroup said it was profitable for the last two months. Just as their stock was cheaper than a McDouble.

What does a big rally look like?

Market Wrap 3/9/9

Woo hoo! It's square root day! Made a handful of trades today. Got chopped up, but a late day $FAZ trade brought me above water. Was late getting back from Hollywood, so glad I was out most of the day.

Market Wrap 3/6/09

The mkts were choppy today. Was 7/7 on bad trades as I neglected to nurse them. Only small losses, so money mgmt working well.

This is my first post from my Mogul. Just like on a PC, but smaller screen/keyboard.

This is my first post from my Mogul. Just like on a PC, but smaller screen/keyboard.

John Stewart Rips CNBC

The best rip on CNBC yet. "If I followed CNBC's advice, I'd be a millionaire... provided I started with 100 million!?"

Market Wrap 3/4/09

Today was better. The market was up and I recreated the StockFinder charts from scratch (as opposed to importing the charts from Blocks). Performance was much better and also applied a filter to help cut down on the watchlist (it's only 100 to begin with!?). It found some nice setups for me and had a pretty good day with 6 wins out of 7 trades.

My indicators show that yesterday and today were both 90% days. Not sure how today could be because the markets were all up by 2.25 to 2.5%.

I think Thursday could be a good entry day for some overnight trades, but unemployment comes out on Friday, so that might be a better day. Any big push down could be a good buying opportunity as the McLellan Osc. is oversold.

My indicators show that yesterday and today were both 90% days. Not sure how today could be because the markets were all up by 2.25 to 2.5%.

I think Thursday could be a good entry day for some overnight trades, but unemployment comes out on Friday, so that might be a better day. Any big push down could be a good buying opportunity as the McLellan Osc. is oversold.

Market Wrap 3/3/09

Day off in the post. Today was testing day with StockFinder. The performance was horrible. Way too slow for day trading and it can't handle 3 real-time charts at the same time with some basic indicators.

My first trade was bad because TOS reset the default trade to LIMIT instead of STOPLIMIT. Ended the day in the red. Still paper trading my setups, but I don't like any losses.

My first trade was bad because TOS reset the default trade to LIMIT instead of STOPLIMIT. Ended the day in the red. Still paper trading my setups, but I don't like any losses.

Market Wrap 3/2/09

March 2nd brings more of the same. Tankity-tank. DJIA down 4.24%, SP500 down 4.66%, NASDAQ down 3.99% and the NYSE down 5.55%. S&P closed just above $700. Still feeling a rally before a big drop so "they" can suck in some IRA money.

Another 90% down day, last one was 2/17/09, which was followed by a 90% up day on Feb 24th.

As planned, signed up for StockFetcher Platinum today. So far so good after loading one chart from Blocks, but still waiting for the feed to download 9 months of data - the last time I used Blocks in real time.

No trades today, looked away for a moment and missed the setup in the morning and about the same thing happened late in the day. Hopefully StockFinder will help with that.

Another 90% down day, last one was 2/17/09, which was followed by a 90% up day on Feb 24th.

As planned, signed up for StockFetcher Platinum today. So far so good after loading one chart from Blocks, but still waiting for the feed to download 9 months of data - the last time I used Blocks in real time.

No trades today, looked away for a moment and missed the setup in the morning and about the same thing happened late in the day. Hopefully StockFinder will help with that.

Market Wrap 2/27/09

February went down the toilet, breaking the November lows, 20 year trend lines and a new monthly closing low. Not good signs. With all the doom going on, I had my best day trading week thus far. Finished the month in the green. Just sticking to my rules and waiting for the trade to come to me. Can be pretty boring, but it's cool when it works!

Reviewing some of the market indicators and how they reacted in the recent past, we should get some kind of movement in about 15-20 days starting from the Feb 23rd low. So late next week we could have a nice little rally. Just in time for St. Patty's day??

Reviewing some of the market indicators and how they reacted in the recent past, we should get some kind of movement in about 15-20 days starting from the Feb 23rd low. So late next week we could have a nice little rally. Just in time for St. Patty's day??

Mark Wrap 2/25/09

Another roller coaster ride with the markets today. Best day trading results so far with a number of trades with FAZ, FAS, COST, DXO, BGZ & TLM.

Looks like distribution days across the indexes. The market tanked in the early hours; then recovered before Obama's comments and headed south again as he opened his mouth. Not sure why he didn't wait until after the markets closed?

Looks like distribution days across the indexes. The market tanked in the early hours; then recovered before Obama's comments and headed south again as he opened his mouth. Not sure why he didn't wait until after the markets closed?

Market Wrap 2/24/09

Today had big gains across the board. The S&P up 4%, the DJI up 3.3% and the Naz 3.9%. I heard Bernanke painted a rosy picture saying the end of the recession will be around the end of 2009. He must be passing the bong with Phelps.

It was a 90% up-day. Even though a lot of short covering going on, we should get a nice little rally over the next few days to weeks. The McLellan was around -340 yesterday, which signals a good buying opportunity. Should get confirmation soon if the rally is to continue.

I dabbled in some FAZ for a small profit while it nose dived. Also picked up some FDLR and holding it for a bit.

It was a 90% up-day. Even though a lot of short covering going on, we should get a nice little rally over the next few days to weeks. The McLellan was around -340 yesterday, which signals a good buying opportunity. Should get confirmation soon if the rally is to continue.

I dabbled in some FAZ for a small profit while it nose dived. Also picked up some FDLR and holding it for a bit.

Market Wrap 2/19/09

Another choppy day in the markets as it tries to decide if it's a tank or airplane. Came out with 4 smackers, so am a happy pilot either way.

The S&P closed below 800. Friday will be important to see if we get a weekly close below 800. The DJ30 undercut the November lows and closed just above it. A nice little head fake. Hard to imagine the market tanking just as people are contributing to their IRA's. Could have a nice rally until late April.

The S&P closed below 800. Friday will be important to see if we get a weekly close below 800. The DJ30 undercut the November lows and closed just above it. A nice little head fake. Hard to imagine the market tanking just as people are contributing to their IRA's. Could have a nice rally until late April.

Market Wrap 2/17/09

Markets sold off hard today. Lots of bad news over the weekend with Japan's GDP tanking and Switzerland borderline insolvency among the top items. Obama signed the new stimulus bill into action today and the market sold off to it's lows after that.

Indicators are all down. It was a 90% down day, the McLellan Summation turned down. The S&P, DJ30 and NASDAQ all undercut the recent lows which will surely put the status back to Market in Correction.

I stayed out the entire day as a spectator. I was traveling back from Miami when the market opened and most of the damage had been done in the first couple of hours.

BWP, SYNA, SY & DMND look like a possible longs if the market bounces. QSII might be a good short, but it's part of the IBD 100. ASEI looks like another possible short.

Indicators are all down. It was a 90% down day, the McLellan Summation turned down. The S&P, DJ30 and NASDAQ all undercut the recent lows which will surely put the status back to Market in Correction.

I stayed out the entire day as a spectator. I was traveling back from Miami when the market opened and most of the damage had been done in the first couple of hours.

BWP, SYNA, SY & DMND look like a possible longs if the market bounces. QSII might be a good short, but it's part of the IBD 100. ASEI looks like another possible short.

Market Wrap 2/12/09

The markets were in tank-ity tank mode today. But then there was a leak that Obama is going to help pay for people's houses who are in trouble. Great. The DJI recovered from 200+ point decline to almost positive in about 45 minutes. Dorks! The recovery put the S&P back inside its triangle pattern. So could see a bounce up to test the upper TL around 900.

Then there was talk about creating all these jobs with the new stimulus plan by building/repairing roads and bridges. Well, not sure how many white collar workers and burger flippers are ready to get their hands dirty? I guess all those former home construction workers might be able to ramp up relatively quickly. And a lot of talk on CAT will benefit from heavy equipment sales. Well, there's already a lot of CAT equipment already sitting around and rusting that will most likely be used before any new equipment is ordered. Unless CAT has some hefty margins on parts? Not seeing any jump in revenue. I pass a sky-lift rental business on the Tri-Rail frequently and their lot is jammed full of cherry pickers. The I-95 expansion in WPB is nearing completion too, so those people will have to be re-allocated too.

Bought some GLD in the morning for $92.75 and then sold when things starting getting wacky for $93.55 - a nice little 80c profit. Better than a poke in the eye with a sharp stick as they say...

Then there was talk about creating all these jobs with the new stimulus plan by building/repairing roads and bridges. Well, not sure how many white collar workers and burger flippers are ready to get their hands dirty? I guess all those former home construction workers might be able to ramp up relatively quickly. And a lot of talk on CAT will benefit from heavy equipment sales. Well, there's already a lot of CAT equipment already sitting around and rusting that will most likely be used before any new equipment is ordered. Unless CAT has some hefty margins on parts? Not seeing any jump in revenue. I pass a sky-lift rental business on the Tri-Rail frequently and their lot is jammed full of cherry pickers. The I-95 expansion in WPB is nearing completion too, so those people will have to be re-allocated too.

Bought some GLD in the morning for $92.75 and then sold when things starting getting wacky for $93.55 - a nice little 80c profit. Better than a poke in the eye with a sharp stick as they say...

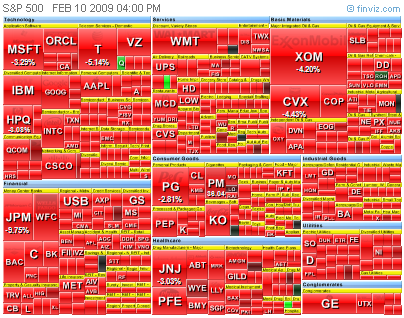

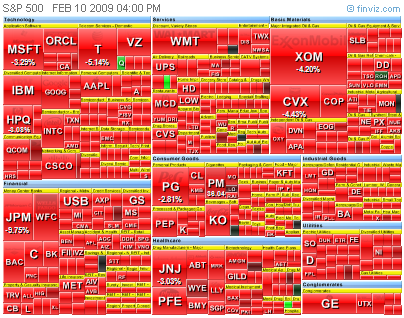

Timmy Tanked the Markets

Notables: 90% Down day, IBD Markets Under Pressure from undercutting previous low on higher volume.

Following a new 8/20 trading system, I see the SPY and DIA were excellent shorting setups from yesterday. I wasn't focused on the market, just observing and waiting to

see the reaction to the SEC statements and then the FED hearing. Nothing good coming on the horizon, except billions of people's IRA contributions in the next couple of months. Dow -4.62%, S&P -4.91%

Will be watching these on Wednesday as they are hanging on a trend line... SHEN AAON LPHI MCD SJI NCIT CPSI PETS

Just about everything was down...

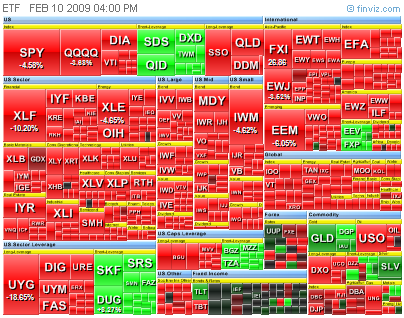

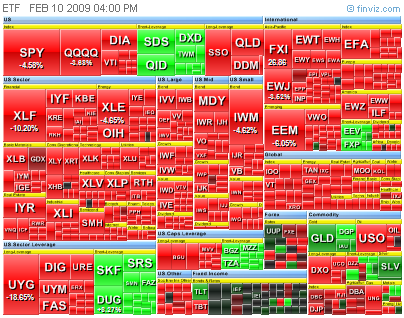

ETF activity...

Following a new 8/20 trading system, I see the SPY and DIA were excellent shorting setups from yesterday. I wasn't focused on the market, just observing and waiting to

see the reaction to the SEC statements and then the FED hearing. Nothing good coming on the horizon, except billions of people's IRA contributions in the next couple of months. Dow -4.62%, S&P -4.91%

Will be watching these on Wednesday as they are hanging on a trend line... SHEN AAON LPHI MCD SJI NCIT CPSI PETS

Just about everything was down...

ETF activity...

Weekend Review

Just catching up and review charts from over the weekend after the market close on Monday. Things to notice: 90% up day on Friday; IBD also changed status to Market in Confirmed Rally; McLellan Summation popped back above zero and the weekly S&P closed at the 13 SMA.

Didn't do much with the market today. Was on my way back from Miami and the stimulus bill was delayed until Tuesday.

Doing some research on TradeStation to consider it as a trading platform. They're coming to the area in April, so will wait until then to check it out.

Think or Swim updated their platform on Friday and another update today. Looks like at least one of my indicators doesn't work at the moment and it crashed TOS when trying to modify it.

Didn't do much with the market today. Was on my way back from Miami and the stimulus bill was delayed until Tuesday.

Doing some research on TradeStation to consider it as a trading platform. They're coming to the area in April, so will wait until then to check it out.

Think or Swim updated their platform on Friday and another update today. Looks like at least one of my indicators doesn't work at the moment and it crashed TOS when trying to modify it.

IBD 100 2009-02-02

Some IBD Stocks flirting with S/R/TL: CWT GENZ CMN DLTR ATHN HAE NITE SJI AZO ALG WW BLU EW ESI NVO EPIQ TTEK HMSY GMCR CMP TDG CFL SXCI GILD RAH MFE EBS GXDX AAON HS SXE APEI MCD JCOM

Market Wrap 1/31/09

The indexes finished down for the month - not a good sign. Reviewing my market indicators... We had a 90% down day on 1/29. The McClellan Summation index peaked over 250 at the beginning of January, the highest I have history for (back to 2001) and appears to coincide with a recent market top at the time. Although I think the market goes lower, I can't imagine the Man letting the market tank just as everyone is engorging their IRA's for the year. Why not let the peasants drink their cool-aid before telling them it's poisoned?

After reading some of Harry Dent's research, not even considering going long in the market for at least a few years and my indicators confirm some kind of turn. Although I will continue short-term trading and hone my day trading skillz.

Gold closed above the 10 month SMA. A bullish sign...

Have many sector RSI signals. Have to figure out where to focus next week.

After reading some of Harry Dent's research, not even considering going long in the market for at least a few years and my indicators confirm some kind of turn. Although I will continue short-term trading and hone my day trading skillz.

Gold closed above the 10 month SMA. A bullish sign...

Have many sector RSI signals. Have to figure out where to focus next week.

Harry Dent is my new Peter Schiff

Got an e-mail tonight from a personal growth site pushing a webinar featuring information from Harry Dent about what/when/how to invest in the coming years for the big downfall. Well, instead of paying for the webinar I Googled his name and quickly became enthralled!

I first found a link to a small book review and a chart that accurately predicts what's going on now. Then was amazed to learn the book was written in the 90's. Then looked on Amazon for all his books and found The Great Depression Ahead. I'm going to the bookstore tomorrow to check it out and have ALL his books on order from the Library (they all have waiting lines).

Then found some free stuff on his website. And some videoz on CNBC and FOX. After recommending gold, it just happened to take off that day or the day after...

His generational waves seem to coincide with the Kondratieff waves and they both point to a shit storm.

I first found a link to a small book review and a chart that accurately predicts what's going on now. Then was amazed to learn the book was written in the 90's. Then looked on Amazon for all his books and found The Great Depression Ahead. I'm going to the bookstore tomorrow to check it out and have ALL his books on order from the Library (they all have waiting lines).

Then found some free stuff on his website. And some videoz on CNBC and FOX. After recommending gold, it just happened to take off that day or the day after...

His generational waves seem to coincide with the Kondratieff waves and they both point to a shit storm.

IBD Watch List

Today was a follow-through day for all major indexes. FMOC was pretty much uneventful. FED to create a bad bank to hold all the crappy assets.

Today's scan about 40 stocks around some kind of support/trend line: DLTR MNRO TDG GMCR JOSB STRL HANS THOR SXL GTIV CMTL LHCG CFL TNH BLUD ASEI MYGN CMN HEI ATHN HMSY MANT INSU NCIT BKC GILD QSII DTV AAON HS AIPC INT LPHI SJI EPIQ NFLX NITE CEPH CWT SHEN AZO TWGP UBNK

DLTR looks real interesting.

Today's scan about 40 stocks around some kind of support/trend line: DLTR MNRO TDG GMCR JOSB STRL HANS THOR SXL GTIV CMTL LHCG CFL TNH BLUD ASEI MYGN CMN HEI ATHN HMSY MANT INSU NCIT BKC GILD QSII DTV AAON HS AIPC INT LPHI SJI EPIQ NFLX NITE CEPH CWT SHEN AZO TWGP UBNK

DLTR looks real interesting.

Traded SPY

Traded SPY on potential breakout, but adjusted stop too soon and got... stopped out! Go figure... At least broke even.

Starting to record my trades live with jingproject.com for setup, execution and review to help improve trade discipline. Will keep them offline, at least until I get more proficient.

Starting to record my trades live with jingproject.com for setup, execution and review to help improve trade discipline. Will keep them offline, at least until I get more proficient.

IBD Watchlist

Keeping my eye on these IBD stocks... Support: MLHR, Resistance: PETM CVH HWAY NOC AGP HUM TDG AET, Breaking upper trend: MOH MD GR KMX DVA PAY UAM

Could get some movement on FMOC comments on Wednesday and possible follow through if mkt goes positive.

Could get some movement on FMOC comments on Wednesday and possible follow through if mkt goes positive.

Charts for the week

Updated my charts a little by adding horizontal price pointers so they're easy to see on the price scale. Added auto-trend lines in yellow. Also updated my thumbnail generator to use GIF for thumbnails so they're half the size and spit out the template for the blog entry. Things are getting easier. Will make the price color white to see if that makes the thumbnails easier to read.

PETM messing with resistance. If the market turns either way, it will probably follow.

MLHR will most likely head south. Who is buying office furniture in this environment? And with all the businesses going under, there will be a big secondary market. Just like when Enron collapsed, you could get Aeron chairs for cheap!

HUM is another one that can pop.

CSTR will benefit from everyone cashing in their piggy banks. Which reminds me...

WCG broke out of a symmetrical triangle. Could use a little test before making a move.

PETM messing with resistance. If the market turns either way, it will probably follow.

MLHR will most likely head south. Who is buying office furniture in this environment? And with all the businesses going under, there will be a big secondary market. Just like when Enron collapsed, you could get Aeron chairs for cheap!

HUM is another one that can pop.

CSTR will benefit from everyone cashing in their piggy banks. Which reminds me...

WCG broke out of a symmetrical triangle. Could use a little test before making a move.

TECH is testing support

TECH is testing support. Could get a little bounce, but the market is pretty messed up right now and this is a descending triangle pattern.

Pepsi and others

PAS looks interesting. Found it through a finviz.com scan. No annotations, I think it speaks for itself.

Here are a few charts from the NASDAQ 100 that look interesting:

APPL will gap open in the morning after positive earnings tonight. It reached into the low 90's. Will probably pull back a ways into the gap.

Dow Up 3.5% after Obamanation

Big reversal today from yesterdays big slide. My IBD scan shows 17% of IBD 100 (that's 17 stocks for the short bus riders) hovering around recent resistance (potential buy points). CMTL is hovering around it's support area, the only one of the bunch according to my scanner anyway. The financial inverse ETFs tanked big time.

Took a small position in JPT

Palm hits the target area

90% Down Day & McLellan

According to my home-brewed indicator, today was a 90% Down day (meaning 90% of overall stocks were down). Although not as significant as 90% Up days according to the creator, we had one today and one on 1/14/09, which was the first since 12/1/08. However, that was a blip as there were two 90% Up Days the week before which is a good sign the market is about to rally (which it did).

The McLellan Summation Index has also rolled over a bit. Although it could reverse, my feeling is it's not going to happen. (It just briefly turned positive since going negative in June '08.)

The McLellan Oscillator also reached over 300 the first week of January, which is a sign the market is overbought and most likely to take a breather (or correction).

One last little tidbit is there is also a strong 20/40 week cycle coming into play. The various dates I used had a cycle "hit" from about 1/11/09 to 1/23/09 as setup in my Google Calendar as a reminder. Kind of strange it just happened to be around inauguration day!?

The McLellan Summation Index has also rolled over a bit. Although it could reverse, my feeling is it's not going to happen. (It just briefly turned positive since going negative in June '08.)

The McLellan Oscillator also reached over 300 the first week of January, which is a sign the market is overbought and most likely to take a breather (or correction).

One last little tidbit is there is also a strong 20/40 week cycle coming into play. The various dates I used had a cycle "hit" from about 1/11/09 to 1/23/09 as setup in my Google Calendar as a reminder. Kind of strange it just happened to be around inauguration day!?

Obama Wins, Market Loses!

CTSH

CTSH could hit $27 area if it can break out of the short term resistance. Or head south to 16 if the market turns sour.

Subscribe to:

Posts (Atom)